Polypropylene Market Size to Worth USD 211.91 Billion by 2034

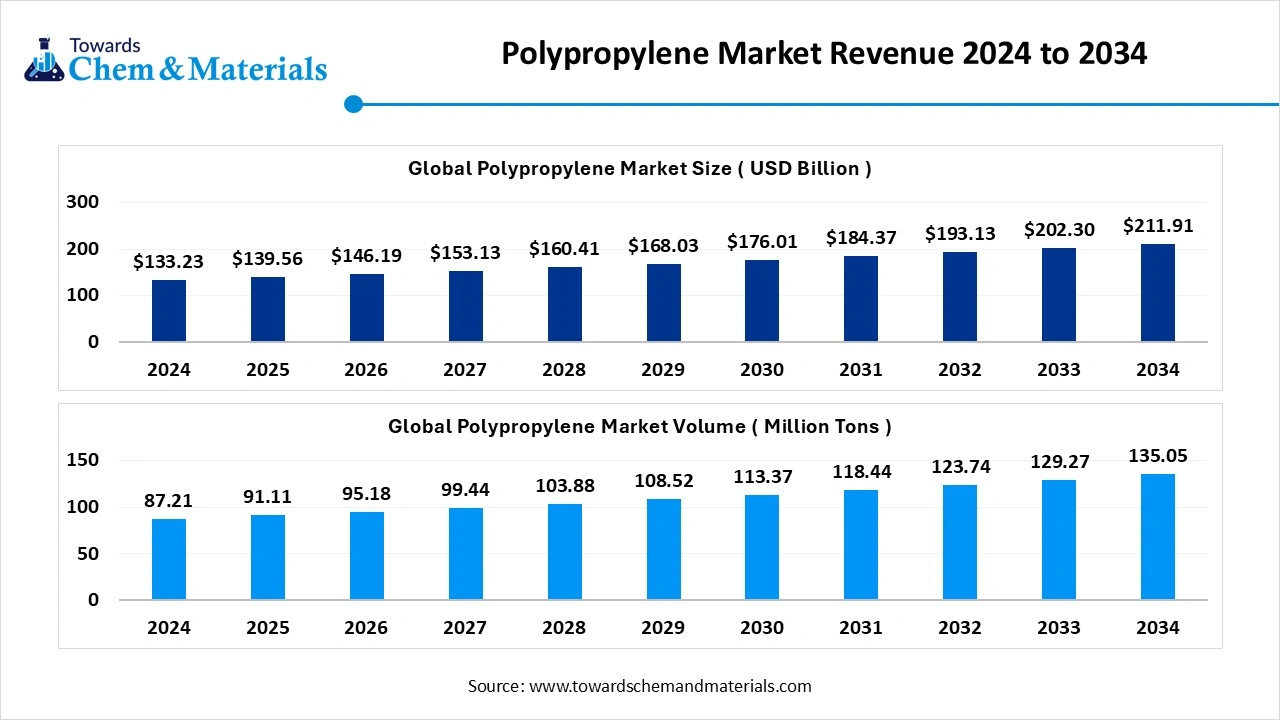

According to Towards Chemical and Materials, the global Polypropylene market size was reached at USD 133.23 billion in 2024 and is expected to be worth around USD 211.91 billion by 2034, growing at a compound annual growth rate (CAGR) of 4.75 % over the forecast period 2025 to 2034.

Ottawa, Sept. 10, 2025 (GLOBE NEWSWIRE) -- The global polypropylene market volume is valued at 91.11 million tons in 2025 and is anticipated to reach around 135.05 million tons by 2034, growing at a compound annual growth rate (CAGR) of 4.47% over the forecast period from 2025 to 2034. The growth of the market rising demand for lightweight and durable packaging materials in the food and consumer goods industry is driving the growth of the market. A study published by Towards Chemical and Materials a sister firm of Precedence Research.

Download a Sample Report Here@ https://www.towardschemandmaterials.com/download-sample/5729

Polypropylene Market Overview

The global polypropylene market is experiencing strong growth due to its versatile properties and wide ranging applications across industries such as packaging, automotive, healthcare, and construction. Asia Pacific holds a dominant position in the market, driven by rapid industrialization and high demand from packaging and automotive sectors, while North America remains a significant player with steady growth supported by technological advancements and increasing demand in various end use industries. By product type, the homopolymer segment leads the market due to its broad industrial applications, and injection modelling is the most widely used processing technology. In terms of end use, the packaging sector remains the largest segment, benefiting from polypropylene’s cost effectiveness, durability, moisture resistance, and high temperature tolerance.

The Key factors driving market growth include the rising need for lightweight and durable packaging materials, increased use of polypropylene in automotive components to improve fuel efficiency, growing applications in healthcare products and medical devices, and a focus on sustainability initiatives such as recycling and the development of bio-based polypropylene. Continuous innovation in processing technologies and product development further enhances polypropylene’s performance and opens new opportunities for growth. Overall, the polypropylene market is poised for continued expansion, supported by its diverse applications, technological advancements, and strong regional demand, providing significant opportunities for manufacturers and stakeholders globally.

Polypropylene Market Report Highlights

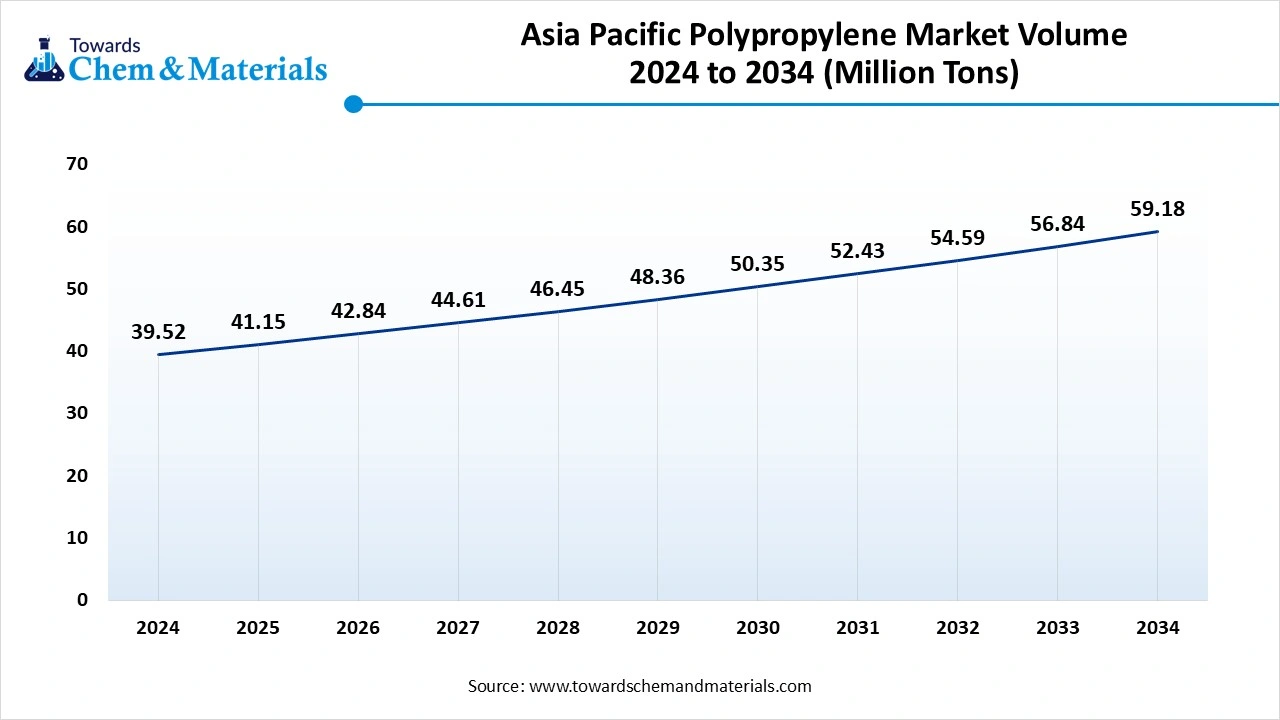

- The Asia Pacific polypropylene market volume was estimated at 39.52 million tons in 2024 and is expected to reach 59.18 million tons by 2034, growing at a CAGR of 34.12% from 2025 to 2034.

- The Asia Pacific polypropylene market held the largest volume Share of 45.31% of the global market in 2024.

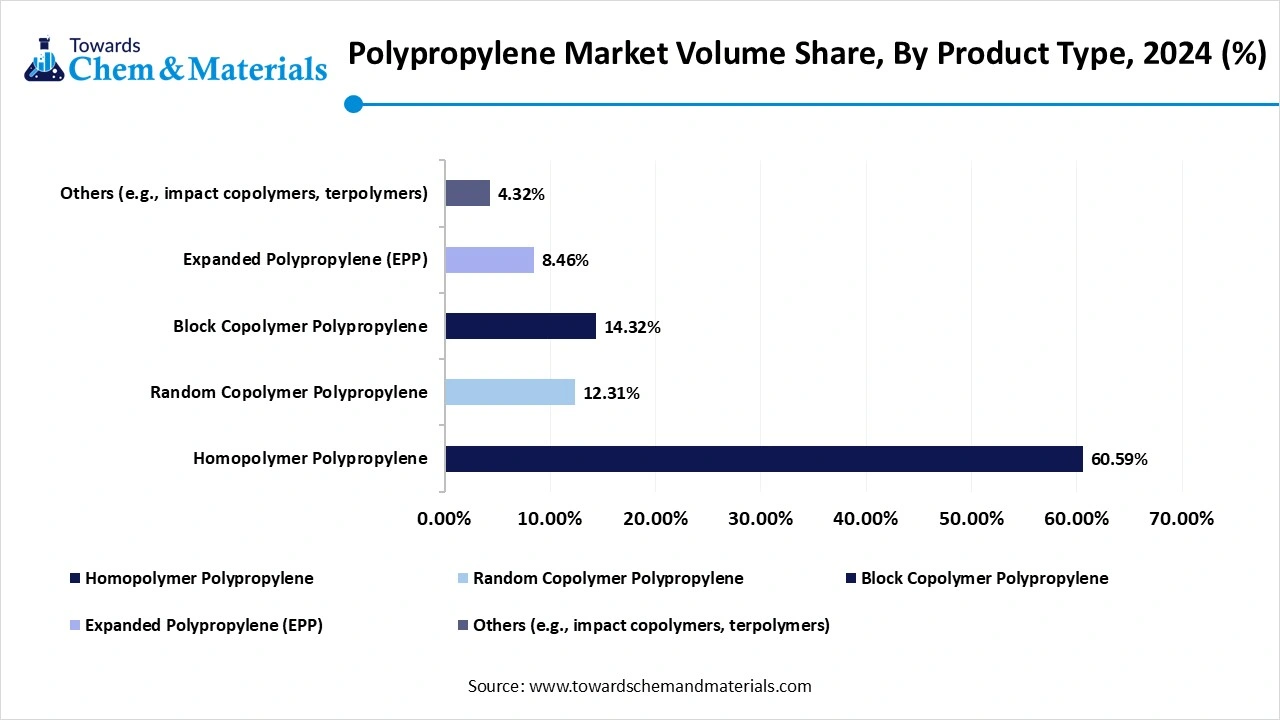

- By product type, the homopolymer polypropylene segment dominated the market with the largest volume Share of 60.59% in 2024.

- By processing technology, the injection molding segment held a 35% share in the market in 2024 due to the growing creation of complex packaging designs.

- By end-use industry, the packaging segment held a 38% share in the market in 2024 due to the increasing demand for food packaging.

Buy Now this Premium Research Report at a Special Price Against the List Price With [Express Delivery] @ https://www.towardschemandmaterials.com/price/5729

Polypropylene Market Report Scope

| Report Attribute | Details |

| Market size value in 2025 | USD 139.56 billion |

| Revenue forecast in 2034 | USD 211.91 billion |

| Growth rate | CAGR of 4.75 % from 2025 to 2034 |

| Base year for estimation | 2024 |

| Historical data | 2021 - 2024 |

| Forecast period | 2025 - 2034 |

| Quantitative units | Volume in kilotons, revenue in USD million, and CAGR from 2025 to 2034 |

| Report coverage | Volume forecast, revenue forecast, competitive landscape, growth factors, and trends |

| Segments covered | By Product Type, By Processing Technology, By End-Use Industry, By Region |

| Regional scope | North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

| Country Scope | U.S.; Canada; Mexico; Germany; U.K.; France; Italy; China; India; Japan; Brazil; Argentina; GCC Countries; South Africa |

| Key companies profiled | LyondellBasell Industries, ExxonMobil Chemical, SABIC, Braskem, Borealis AG, TotalEnergies Petrochemicals, Reliance Industries Limited, Indian Oil Corporation, HMC Polymers, Formosa Plastics Group, PetroChina Company Limited, Sinopec Group, Mitsui Chemicals, LG Chem, Hanwha Total Petrochemical, Hyosung Chemical, Japan Polypropylene Corporation, Westlake Corporation, INEOS Olefins & Polymers, Qatar Petrochemical Company (QAPCO) |

For more information, visit the Towards Chemical and Materials website or email the team at sales@towardschemandmaterials.com| +1 804 441 9344

What Are The Major Trends In The Polypropylene Market?

- Sustainability and recycling initiatives- companies are increasingly focusing on producing recyclable and bio-based polypropylene to reduce environmental impact and meet growing consumer demand for sustainable materials.

- Growth in Automotive applications- Lightweight polypropylene components are being widely adopted in the automotive industry to improve fuel efficiency and reduce vehicle weight, driving new demand.

- Expansion in Packaging Industry- the rise in e-commerce and food and beverage demand is boosting the use of polypropylene for durable, lightweight, and cost effective packaging solutions.

- Technological Advancements- Innovations in polymerization techniques, processing technologies like injection moulding and extrusion, and enhanced material properties are enabling broader industrial applications and improved product performance.

Here Are Some of the Top Products in the Polypropylene Market

- Injection Melding Products- Used in automotive parts, appliances, and consumer goods due to excellent moldability and toughness.

- Film & Sheet- Widely used in packaging (food wraps, bags), agriculture films, and labelling.

- Fiber (Staple & Filament)- Used in carpets, upholstery, geotextiles, and non-woven fabrics like hygiene products.

- Blow Melding Products- Used for bottles, containers, and large hollow items in packaging and household goods.

- Raffia / Tapes- Used in woven sacks, FIBCs (bulk bags), ropes, and twines.

- Biaxially Oriented Polypropylene (BOPP)- Key in food packaging, labels, and printing applications due to clarity and strength.

- Random Copolymer PP- Used in medical devices, packaging, and piping due to high clarity and impact strength.

- Impact Copolymer PP- Common in automotive, appliances, and industrial applications needing toughness.

- Pipes and Fittings- PP-R and PP-H used in plumbing, HVAC, and industrial fluid systems.

- Automotive Parts- Bumpers, dashboards, battery cases – valued for lightweight and chemical resistance.

Polypropylene Market Growth Factors

Can AI Rescue Food Grade Polypropylene Recycling At Scale?

AI enabled sorting technologies deployed at Material Recovery Facilities (MRFs) are transforming how food grade polypropylene (often used in beverage cups and yogurt tubs) is recovered. These systems analyse each item on conveyor belts detecting shape, mass, and likelihood of being food grade to classify and separate PP with remarkable accuracy. This granular, AI assisted insight enables MRF operators to create dedicated bales of food grade OO, significantly boosting recycling efficiency, material quality, and value recovery.

Could AI Powered Production Optimization Boost Polypropylene Plants Efficiency?

Manufacturers are increasingly leveraging artificial intelligence such as generative AI, predictive maintenance systems, and technical assistants to streamline plastic processing operations. These AI tools analyse machine operational data to fine tune production parameters, anticipate equipment failures, and reduce downtime. As a result, facilities can maintain consistent polypropylene quality, improve overall equipment effectiveness, and cut waste making operations more efficient and cost effective.

Market Opportunity

Could Nigeria Become Africa’s Polypropylene Export Powerhouse?

Nigeria has inaugurated Africa’s largest polypropylene production plant in Logos with a capacity of 830,000 metric tonnes annually. Partnering with Vinmar Group to export its PP products, Nigeria is poised to transform from a net importer into a significant exporter in the global polypropylene market. This strategic shift opens a major opportunity for expanding regional supply chains and strengthening global trade in polypropylene.

Will FDA Approved Recycled PP unlock Food Grade Closed Loop Solutions?

Genox LyondellBasell New Material Co.(GXLYB) a joint venture between LyondellBasell and Genox Recycling has secured FDA ‘No Objection Letters’ for its mechanical recycling processes tailored for recycled PP and HDPE. These approvals affirm that GXLYB’s recycled polypropylene meets rigorous safety standards, enabling its use in food contact applications. This breakthrough paves that way for high quality recycled PP to enter packaging, consumer goods, and even personal care products, boosting circular economy opportunities.

Limitations in the Polypropylene Market

- Raw material price volatility- the cost of propylene production is highly sensitive to fluctuations in the prices of its petroleum based feedstocks like crude oil and propylene. Such volatility disrupts cost forecasting, squeezes profit margins, and makes long term planning difficult for manufacturers. This instability is a persistent obstacle to maintaining stable pricing and operational efficiency.

- Recycling and Circularity Challenges- Despite polypropylene being recyclable in principle, practical recycling remains hindered by technical and infrastructural barriers. Contamination, complex identification, degradation during processing, and a lack of specialized facilities severely limit recycling rates resulting in most polypropylene waste ending up in landfills or incineration. These factors pose significant challenges to sustainability and circular economy efforts.

Why Does Asia Pacific Dominate the Polypropylene Market?

The Asia Pacific polypropylene market Volume was estimated at 39.52 million tons in 2024 and is anticipated to reach 59.18 million tons by 2034, growing at a CAGR of 34.12% from 2025 to 2034.

Asia Pacific dominates the global polypropylene market in 2024, fuelled by rapid industrialization, urbanization, and strong demand from end use sectors such as packaging, automotive, consumer goods, and construction. The region benefits from abundant raw material availability, large scale manufacturing capacity, and cost-effective labour, making it a hub for polypropylene production and consumption. The booming e-commerce sector and growing food and beverage packaging needs are also contributing significantly to the region’s dominance. Moreover, governments in the region are supporting recycling initiatives and sustainable material use, further driving polypropylene adoption in diverse applications.

Polypropylene Market Volume Share, By Region, 2024-2034 (%)

| By Region | Volume Share, 2024 (%) | Market Volume – 2024(Million Tons) | Market Volume – 2034 (Million Tons) | CAGR (2025 - 2034) | Volume Share, 2034 (%) | |||

| North America | 20.14 | % | 17.56 | 28.54 | 5.54 | % | 21.13 | % |

| Europe | 23.12 | % | 20.16 | 32.59 | 5.48 | % | 24.13 | % |

| Asia Pacific | 45.31 | % | 39.52 | 56.83 | 4.12 | % | 42.08 | % |

| Latin America | 7.20 | % | 6.28 | 10.64 | 6.04 | % | 7.88 | % |

| Middle East & Africa | 4.23 | % | 3.69 | 6.46 | 6.41 | % | 4.78 | % |

| Total | 100.00 | % | 87.21 | 135.05 | 4.47 | % | 100.00 | % |

China plays the most influential role within the Asia Pacific polypropylene market, supported by its massive industrial base, strong domestic consumption, and strategic investments in petrochemical infrastructure. The country has emerged as both a leading producer and consumer of polypropylene, with packaging, automotive, and electronics industries being major growth drivers. China’s policies promoting advanced manufacturing and recycling are also accelerating innovations in polypropylene applications. Additionally, the nation’s large population and expanding middle class continue to fuel demand for packaged goods, vehicles, and healthcare products all of which rely heavily on polypropylene. This combination of industrial strengths and consumer demand cements China’s position as the key growth engine in the regional market.

Why Is Middle East & Africa the Fastest Growing Polypropylene Market?

The Middle East & Africa are witnessing the fastest growth in the polypropylene market during the forecast period, propelled by rapid urbanization, substantial infrastructure projects, and surging demand in consumer goods sectors. Booming industrial corridors and smart city initiatives are also boosting polypropylene usage. Additionally, the expansion of e-commerce and the drive toward sustainable packaging solutions are further fuelling adoption in the region.

Polypropylene Market Segmentation

Product type Insights

Why Does the Homopolymer Segment Dominate the Polypropylene Market In 2024?

The homopolymer segment dominate the market in 2024, due to its versatile properties, including strengths, stiffness, and chemical resistance, making it suitable for a wide range of applications. It is widely used in packaging, textiles, households goods, and industrial applications, where durability and cost efficiency are critical. Its ease of processing and ability to meet diverse industry requirements reinforce its leading position in the market.

Expanded Polypropylene (EPP) stands out as the fastest growing during the forecast period, primarily due to its exceptional combination of being lightweight, durable, and highly energy absorbent. Its unique properties such as impact resilience, buoyancy, thermal insulation, and chemical resistance make EPP ideal for a range of high-performance applications. Industries like automotive, e-commerce packaging, consumer goods, and construction are increasingly adoption EPP for components like door panels, bumpers, reusable packaging solutions, and protective materials. The surging demand for lightweight and sustainable materials across these sectors is accelerating EPP’s growth trajectory.

Polypropylene Market Volume Share, By Product Type, 2024-2034 (%)

| By Product Type | Volume Share, 2024 (%) | Market Volume – 2024 (Million Tons) | Market Volume – 2034 (Million Tons) | CAGR (2025 - 2034) | Volume Share, 2034 (%) | |||

| Homopolymer Polypropylene | 60.59 | % | 52.84 | 76.38 | 4.18 | % | 56.56 | % |

| Random Copolymer Polypropylene | 12.31 | % | 10.74 | 17.75 | 5.74 | % | 13.14 | % |

| Block Copolymer Polypropylene | 14.32 | % | 12.49 | 20.99 | 5.94 | % | 15.54 | % |

| Expanded Polypropylene (EPP) | 8.46 | % | 7.38 | 12.59 | 6.12 | % | 9.32 | % |

| Others (e.g., impact copolymers, terpolymers) | 4.32 | % | 3.77 | 7.35 | 7.70 | % | 5.44 | % |

| Total | 100.00 | % | 87.21 | 135.05 | 4.47 | % | 100.00 | % |

Processing Technology Insights

Why Does the Injection Moulding Segment Dominate the Polypropylene Market In 2024?

The injection moulding segment dominate the market in 2024, Injection moulding dominates the polypropylene processing landscape because it allows for the efficient production of complex, high quality components at scale. This technology is widely applied in automotive, consumer goods, and packaging industries, where precision, consistent, and cost effectiveness are essential. Its adaptability to various designs and mass production needs ensures its continuing dominance.

The thermoforming segment is emerging as the fastest growing in the market during the forecast period, thanks to its strong alignment with sustainability and versatility. This method enables the production of cost effective, lightweight. And contaminant protective solutions used in medical device packaging, food trays, blister packs, and protective trays. Its ability to mold polypropylene into varies shapes and sizes, while balancing material efficiency and production speed, makes thermoforming increasingly popular specially in industries where sterility and recyclability are critical.

End Use Insights

Why Does Packaging Sector Segment Dominate the Polypropylene Market In 2024?

The packaging sector segment dominate the market in 2024, due to its lightweight, durability, and resistance to moisture and chemicals. It is the preferred choice for food, beverage, and consumer goods packaging, meeting both performance and cost requirements. The continued expansion of e-commerce and food delivery further strengthens its dominance in the market.

The healthcare and pharmaceuticals sector is the fastest growing in the market during the forecast period, driven by increasing production of medical devices including syringes, surgical instruments, single use products, and IV containers as well as pharmaceutical packaging. Polypropylene’s innate qualities such as durability., chemical resistance, ability to maintain sterility, and cost effectiveness make it specially suitable for these critical applications. Rising healthcare demands and focus on sterile, disposable materials are amplifying its adoption across hospitals, clinics, labs, and drug manufacturing facilities.

More Insights in Towards Chemical and Materials:

- Polyolefin Market : The global polyolefin market volume was valued at 230.72 million tons in 2024 and is estimated to reach around 371.54 million tons by 2034, exhibiting a compound annual growth rate (CAGR) of 4.88% during the forecast period 2025 to 2034.

- Polymer Chameleon Market : The global polymer chameleon market size was reached at USD 415.70 billion in 2024 and is expected to be worth around USD 1,122.13 billion by 2034, growing at a compound annual growth rate (CAGR) of 10.44% over the forecast period 2025 to 2034.

- Bio-Based Polyurethane Market ; The global bio-based polyurethane market size was reached at 4.86 million tons in 2024 and is expected to be worth around 10.73 million tons by 2034, growing at a compound annual growth rate (CAGR) of 8.24% over the forecast period 2025 to 2034.

- Medical Fluoropolymers Market : The global medical fluoropolymers market volume was reached at 8.21 kilo tons in 2024 and is expected to be worth around 13.87 kilo tons by 2034, growing at a compound annual growth rate (CAGR) of 5.39% over the forecast period 2025 to 2034.

- Recycled Polystyrene Market ; The global recycled polystyrene market size was reached at USD 4.95 billion in 2024 and is expected to be worth around USD 7.49 billion by 2034, growing at a compound annual growth rate (CAGR) of 4.23% over the forecast period 2025 to 2034.

- Bio-Based Polymers Market : The global bio-based polymers market size was reached at USD 12.08 billion in 2024 and is expected to be worth around USD 58.36 billion by 2034, growing at a compound annual growth rate (CAGR) of 17.06% over the forecast period 2025 to 2034.

- Polymers Market : The global polymers market size was reached at USD 796.53 billion in 2024 and is expected to be worth around USD 1,351.59 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.43% over the forecast period 2025 to 2034.

- Expandable Polystyrene Market : The global expandable polystyrene market volume was reached at 7.21 million tons in 2024 and is expected to be worth around 9.33 million tons by 2034, growing at a compound annual growth rate (CAGR) of 2.61% over the forecast period 2025 to 2034.

- Polyvinyl Chloride (PVC) Market ; The global polyvinyl chloride (PVC) market size was estimated at USD 86.93 billion in 2024 and is expected to hit around USD 116.26 billion by 2034, growing at a compound annual growth rate (CAGR) of 2.95% over the forecast period from 2025 to 2034.

- Polyethylene Terephthalate (PET) Market ; The global polyethylene terephthalate (PET) market size was reached at 39.25 USD Billion in 2024 and is expected to be worth around 68 USD Billion by 2034, growing at a compound annual growth rate (CAGR) of 5.65% over the forecast period 2025 to 2034.

- Polymer Denture Material Market ; The global polymer denture material market size was USD 2.35 billion in 2024 and is projected to grow from USD 2.49 billion in 2025 to USD 4.11 billion by 2034, exhibiting a CAGR of 5.75% during the forecast period.

- Polyethylene Glycol (PEG) Market : The global polyethylene glycol (PEG) market volume was reached at 450,000 tons in 2024 and is expected to be worth around 788,565.1 tons by 2034, growing at a compound annual growth rate (CAGR) of 5.77% over the forecast period 2025 to 2034.

- Polyglycolic Acid Market : The global polyglycolic acid market size was estimated at USD 6.19 billion in 2024 and is predicted to increase from USD 6.79 billion in 2025 to approximately USD 15.72 billion by 2034, expanding at a CAGR of 9.77% from 2025 to 2034.

- Polyethylene Wax Market : The global polyethylene wax market size was valued at USD 2.35 billion in 2024. The market is projected to grow from USD 2.45 billion in 2025 to USD 3.56 billion by 2034, exhibiting a CAGR of 4.25% during the forecast period.

- Super Absorbent Polymer Market : The global super absorbent polymer market volume was accounted for 3.87 million tons in 2024 and is expected to be worth around 7.92 million tons by 2034, growing at a compound annual growth rate (CAGR) of 7.43% during the forecast period 2025 to 2034.

- Extruded Polystyrene Market : The global extruded polystyrene market size was reached at USD 7.19 billion in 2024 and is expected to be worth around USD 12.70 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.85% over the forecast period 2025 to 2034.

- Polyvinyl Butyral (PVB) Market : The global polyvinyl butyral (PVB) market size was reached at USD 3.89 billion in 2024 and is expected to be worth around USD 7.41 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.65% over the forecast period 2025 to 2034.

- Linear Low-Density Polyethylene (LLDPE) Market : The global linear low-density polyethylene (LLDPE) market size was reached at USD 70.95 Billion in 2024 and is expected to be worth around USD 118.69 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.28% over the forecast period 2025 to 2034.

- Green Methanol Market : The global green methanol market size accounted for USD 2.66 billion in 2024 and is projected to hit around USD 17.84 billion by 2034, expanding at a CAGR of 20.96% during the forecast period from 2025 to 2034.

- Plastics Market : The global plastics market size was reached at USD 651.55 billion in 2024 and is expected to be worth around USD 984.11 billion by 2034, growing at a compound annual growth rate (CAGR) of 4.21% over the forecast period 2025 to 2034.

- Plastic Lidding Films Market : The global plastic lidding films market size was reached at USD 3.33 billion in 2024 and is expected to be worth around USD 5.13 billion by 2034, growing at a compound annual growth rate (CAGR) of 4.42% over the forecast period 2025 to 2034.

- Chemical Distribution Market : The global chemical distribution market volume was reached at 239.32 million tons in 2024 and is expected to be worth around 440.18 million tons by 2034, exhibiting at a compound annual growth rate (CAGR) of 6.28% over the forecast period 2025 to 2034.

- Sodium Carbonate Market : The global sodium carbonate market size was valued at USD 13.03 billion in 2024 and is expected to hit around USD 16.84 billion by 2034, growing at a compound annual growth rate (CAGR) of 2.60% over the forecast period 2025 to 2034.

- Metal Casting Market : The global metal casting market size was reached at USD 152.47 billion in 2024 and is estimated to surpass around USD 262.91 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.60% during the forecast period 2025 to 2034.

- Polysilicon Market : The global polysilicon market size accounted for USD 42.98 billion in 2024 and is predicted to increase from USD 49.90 billion in 2025 to approximately USD 191.24 billion by 2034, expanding at a CAGR of 16.10% from 2025 to 2034.

- Green Cement Market : The global green cement market size was reached at USD 38.19 billion in 2024 and is expected to be worth around USD 69.37 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.15% over the forecast period 2025 to 2034.

- Specialty Chemicals Market : The global specialty chemicals market size is calculated at USD 671.19 billion in 2024, grew to USD 706.36 billion in 2025, and is projected to reach around USD 1,118.55 billion by 2034. The market is expanding at a CAGR of 5.24% between 2025 and 2034.

- Recycled Polyolefin Market : The global recycled polyolefin market size accounted for USD 61.19 billion in 2024, grew to USD 66.67 billion in 2025, and is expected to be worth around USD 144.2 billion by 2034, poised to grow at a CAGR of 8.95% between 2025 and 2034.

- Polyolefin Sheets in Industrial Market : The global polyolefin sheets in industrial market size accounted for USD 8.49 billion in 2024, grew to USD 8.99 billion in 2025, and is expected to be worth around USD 14.99 billion by 2034, poised to grow at a CAGR of 5.85% between 2025 and 2034.

- U.S. Polyolefin Compounds Market ; The U.S. polyolefin compounds market volume was reached at 2.80 million tons in 2024 and is expected to be worth around 4.69 million tons by 2034, growing at a compound annual growth rate (CAGR) of 5.30% over the forecast period 2025 to 2034.

- U.S. Cosmetic Chemicals Market : The U.S. cosmetic chemicals market size was reached at USD 1.15 billion in 2024 and is expected to be worth around USD 4.05 billion by 2034, growing at a compound annual growth rate (CAGR) of 13.43% over the forecast period 2025 to 2034.

- U.S. Enzymes Market : The U.S. enzymes market size was valued at USD 4.25 billion in 2024. The market is projected to grow from USD 4.54 billion in 2025 to USD 8.17 billion by 2034, exhibiting a CAGR of 6.75% during the forecast period.

- Industrial Enzymes Market ; The global industrial enzymes market size reached USD 8.19 billion in 2024 and is projected to hit around USD 16.04 billion by 2034, expanding at a CAGR of 6.95% during the forecast period from 2025 to 2034.

- Enzymes Market : The global enzymes market volume was valued at 746.40 kilo tons in 2024 and is estimated to hit around 1343.40 kilo tons by 2034, growing at a compound annual growth rate (CAGR) of 6.05% during the forecast period 2025 to 2034.

- U.S. Polyvinyl Butyral Market ; The U.S. polyvinyl butyral market size was reached at USD 693 million in 2024 and is expected to be worth around USD 1,320.53 million by 2034, growing at a compound annual growth rate (CAGR) of 6.66% over the forecast period 2025 to 2034.

- U.S. Fluoropolymer Coating Market : The U.S. fluoropolymer coating market volume was reached at 23,400.0 tons in 2024 and is expected to be worth around 39,970.6 tons by 2034, growing at a compound annual growth rate (CAGR) of 5.50% over the forecast period 2025 to 2034.

Polypropylene Market Top Key Companies:

- LyondellBasell Industries

- ExxonMobil Chemical

- SABIC

- Braskem

- Borealis AG

- TotalEnergies Petrochemicals

- Reliance Industries Limited

- Indian Oil Corporation

- HMC Polymers

- Formosa Plastics Group

- PetroChina Company Limited

- Sinopec Group

- Mitsui Chemicals

- LG Chem

- Hanwha Total Petrochemical

- Hyosung Chemical

- Japan Polypropylene Corporation

- Westlake Corporation

- INEOS Olefins & Polymers

- Qatar Petrochemical Company (QAPCO)

Recent Developments

- In May 2025, Nigeria’s Dangote Refinery has partnered with Vinmar Group to export polypropylene from its newly launched petrochemical planting Logos the Largest in Africa. Transitioning from a 90% importer to an exporter, this move is poised to reshape regional supply chains and broaden African presence in the global PP market.

- In May 2025, Jindal Poly Films is investing heavily in its Nashik facility to boost production of BOPP, PPET, and CPP films the project, set to come online within a few years, strengthens its leadership in flexible polypropylene film segments amid pricing pressures and rising packaging demand.

Polypropylene Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2034. For this study, Towards Chemical and Materials has segmented the global Polypropylene Market

By Product Type

- Homopolymer Polypropylene

- Random Copolymer Polypropylene

- Block Copolymer Polypropylene

- Expanded Polypropylene (EPP)

- Others (e.g., impact copolymers, terpolymers)

By Processing Technology

- Injection Molding

- Blow Molding

- Extrusion

- Film & Sheet

- Fiber & Filament

- Thermoforming

- Others (e.g., 3D printing, rotomolding)

By End-Use Industry

- Packaging Industry

- Automotive Industry

- Construction Industry

- Healthcare & Pharmaceuticals

- Textile Industry

- Electrical & Electronics

- Consumer Goods

- Agriculture

- Industrial Manufacturing

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/price/5729

About Us

Towards Chemical and Materials is a leading global consulting firm specializing in providing comprehensive and strategic research solutions across the chemical and materials industries. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations.

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Healthcare | Towards Food and Beverages | Towards Chemical and Materials | Towards Consumer Goods | Nova One Advisor |

For Latest Update Follow Us: https://www.linkedin.com/company/towards-chem-and-materials/

USA: +1 804 441 9344

APAC: +61 485 981 310 or +91 87933 22019

Europe: +44 7383 092 044

Email: sales@towardschemandmaterials.com

Web: https://www.towardschemandmaterials.com/

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.